Brisbane Property Market Forecast into 2025: Trends, Predictions, and Investment Tips

Navigating the Brisbane property market Towards 2025

The Brisbane property market is poised for significant growth as we move towards 2025. With a combination of economic factors, infrastructure development, and increasing demand, Brisbane is becoming an attractive destination for property investors. This comprehensive forecast analyses the Brisbane property market trends, highlights key growth drivers, and offers insights for potential investors.

Economic Growth

The Brisbane property market benefits from Brisbane’s robust economy, driven by diverse industries such as finance, technology, and healthcare. The city's economic stability and growth create a favourable environment for property investment. According to the Australian Bureau of Statistics, Brisbane’s economy is projected to grow at a steady rate, attracting more businesses and residents to the area.

Infrastructure Development

Major infrastructure projects like the Brisbane Metro, Cross River Rail, and the Queen’s Wharf development are set to enhance connectivity and boost the local economy. These developments are expected to increase property values in surrounding areas. For instance, the Cross River Rail will improve access to key employment hubs, making nearby suburbs more attractive for both residential and commercial investments.

Population Growth

The Brisbane property market is experiencing steady population growth due to interstate migration and international arrivals. This population increase fuels demand for housing, leading to a rise in property prices. The Queensland Government estimates that Queensland's population is growing rapidly from the current 5.4 million to between 6.4 and 8.27 million by 2046. Most of this growth is likely to be in the Southeast QLD corridor, in Brisbane, Sunshine Coast and Gold Coast.

Lifestyle Appeal

Brisbane offers a high quality of life with its subtropical climate, cultural attractions, and outdoor lifestyle. This appeal attracts new residents and investors alike. The city’s vibrant arts scene, coupled with its numerous parks and recreational areas, makes it an ideal location for families and young professionals.

Market Trends and Predictions

Residential Property

The residential property market in Brisbane is expected to see continued growth. Suburbs close to the city centre, such as New Farm, Paddington, and West End, are particularly attractive due to their amenities and proximity to employment hubs. According to

CoreLogic, Brisbane’s median house price is projected to increase by 6-8% annually over the next few years.

Commercial Property

Commercial properties are also on the rise, with increased demand for office space and retail locations. Areas like Fortitude Valley and South Brisbane are becoming commercial hotspots. The growth in Brisbane’s tech sector has particularly boosted demand for office spaces, making it a lucrative market for commercial property investors.

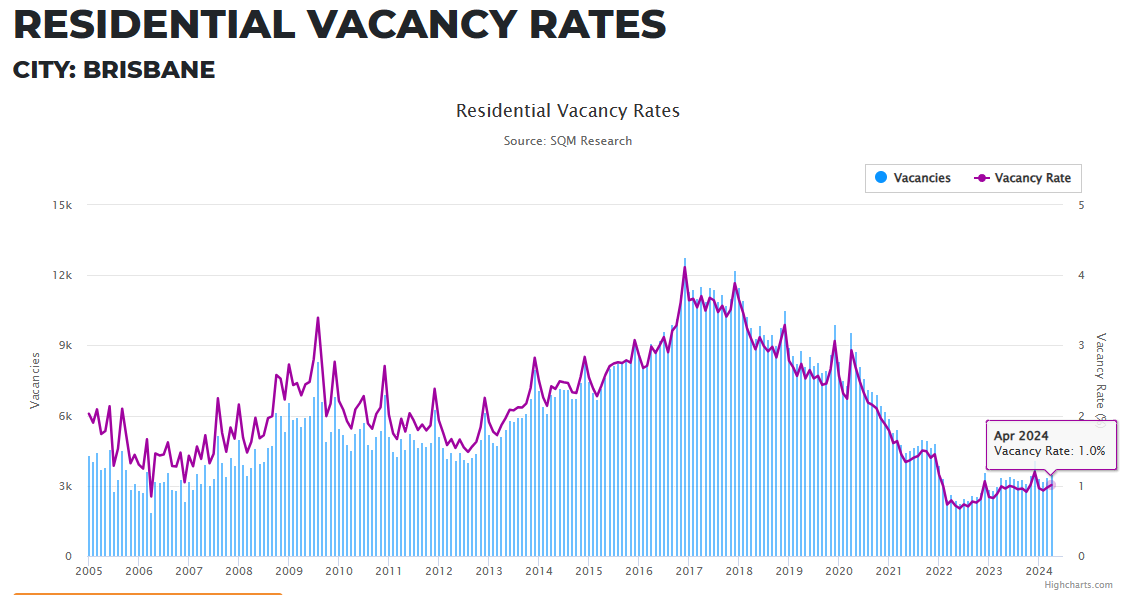

Rental Market

The rental market in Brisbane remains strong, driven by high demand from both local and international renters. Investors can expect stable rental yields, particularly in well-located suburbs. According to SQM Research, Brisbane’s rental vacancy rate is currently at 1% (as of April 2024) indicating a tight rental market with opportunities for outsized rental returns.

Premier property management in Brisbane.

We uphold your investment property standards with regular inspections, maintenance, tenant and finance management.

Suburbs to Watch

New Farm

Known for its riverside parks and vibrant dining scene, New Farm is a prime location for both residential and investment properties within the Brisbane property market. The suburb’s proximity to the CBD and excellent amenities make it a sought-after area. New Farm’s median house price has seen a steady increase, making it a solid choice for long-term investment. Popular local spots include New Farm Park and the Brisbane Powerhouse.

Paddington

With its charming heritage homes and trendy cafes, Paddington is a popular choice for young professionals and families. The suburb offers a mix of lifestyle and convenience, driving property demand. Real estate experts predict Paddington will continue to see strong capital growth due to its appeal and location. Key attractions include Latrobe Terrace and The Barracks.

West End

West End is a cultural hub with a diverse community, bustling markets, and eclectic eateries. Its unique character and close-knit community make it a desirable place to live and invest. West End’s property market is expected to grow as infrastructure improvements increase its connectivity to the rest of the city. Highlights include the

West End Markets and

Boundary Street.

Emerging Areas

- Everton Park - As families continue to seek suburbs with good schools and community facilities, Everton Park stands out. Its ongoing residential developments and enhancements in local amenities are expected to drive demand higher.

- Nundah - Once overlooked, Nundah is undergoing a transformation with new residential and commercial projects. Its affordability compared to more central suburbs, combined with good transport links, positions it as a key area for growth.

Investment Tips

Research and Due Diligence

Investors should conduct thorough research and due diligence before purchasing property. Understanding market trends, property values, and future developments is crucial. Utilize resources like the Brisbane City Council’s planning and development reports to stay informed about upcoming projects that may impact property values.

Long-term Perspective

Property investment in Brisbane should be viewed with a long-term perspective. While short-term gains are possible, the greatest returns come from holding properties over several years. Historical data shows that Brisbane property has consistently appreciated over the long term, making it a reliable investment.

Diversify Portfolio

Diversifying your property portfolio by investing in different types of properties (residential, commercial, and rental) can mitigate risks and maximize returns. Consider areas with strong growth potential and varying market conditions to balance your investment portfolio.

Analysis of Current Trends

As we assess the Brisbane property market's performance leading up to 2025, two primary factors are significant influencers: population growth and economic indicators. These elements not only define the current market conditions but also shape future expectations.

Population Growth and Migration

Brisbane has been experiencing a notable influx of interstate migration, particularly from more expensive Australian states like New South Wales and Victoria. This migration trend is largely driven by Brisbane's relative affordability and appealing lifestyle, positioning it as an attractive alternative to Sydney and Melbourne's high living costs. According to the Australian Bureau of Statistics, Brisbane's population growth is projected to continue, sustaining demand in the housing market as new residents seek both rental accommodations and homes to purchase.

Moreover, the reopening of international borders post-pandemic has reintroduced overseas migrants and students to the city, further tightening the rental market. This demographic shift is anticipated to propel property values upwards, especially in desirable inner-city areas and suburbs with strong community infrastructures such as schools and public transport. Suburbs like Paddington and New Farm are particularly likely to see increased demand.

Economic Indicators

Brisbane's economic landscape is bolstered by substantial investments in infrastructure, notably the preparations for the 2032 Olympic Games. These preparations involve significant enhancements to transportation networks, sporting facilities, and cultural institutions, which are likely to boost property values in adjacent areas.

Employment opportunities generated by these projects contribute to a robust local economy, attracting more professionals and their families to the city. Additionally, the strength of Queensland's mining and agricultural sectors continues to support the broader state economy, indirectly benefiting the property market by maintaining high employment levels. The Queensland Government has emphasized the importance of these sectors in sustaining economic growth and job creation.

Predictions for 2025

House Price Projections

Looking towards 2025, the median house price in the Brisbane property market is expected to reach new heights. Data from CoreLogic as of April 2024 has the average dwelling price in Brisbane at $827,822. Factoring in the historic growth patterns and new investment, predictions suggest a rise to approximately $912,000+ in 2025, reflecting a compounded annual growth driven by sustained demand and limited supply. This projection is underpinned by the continuous flow of migrants into the city and the ripple effects of major infrastructural developments like the Cross River Rail and Brisbane Metro.

Unit and Apartment Market Trends

While the overall property market shows signs of growth, the unit and apartment sector presents a nuanced trajectory. The market for units in Brisbane is set for a major boost, particularly in areas that cater to young professionals and students who are priced out of the detached housing market. Prices for units are expected to stabilize and show moderate growth as new apartment stock in developments like Newstead start to come to market, catching up after a period of slower gains compared to houses.

Investment in this segment should be strategic, focusing on locations near universities, major employment hubs, or lifestyle amenities like cafes, parks, and cultural spots. Areas like

Fortitude Valley and South Brisbane, known for their vibrant lifestyle and proximity to key attractions, are likely to offer higher rental yields and capital appreciation over time due to ongoing demand.

Challenges and Opportunities

Potential Risks

Investing in any property market always comes with its set of challenges. always comes with its set of challenges. In Brisbane, potential risks include:

- Interest Rate Increases: Potential hikes in interest rates could impact borrowing costs, thereby affecting buyer affordability and cooling market demand. Monitoring the Reserve Bank of Australia for policy changes is crucial for staying ahead of these shifts.

- Economic Fluctuations: While Brisbane's economy is robust, external economic pressures could influence property market performance, especially if commodity prices fluctuate or there is a broader national economic downturn. Keeping an eye on economic reports from sources like the Australian Bureau of Statistics can help mitigate these risks.

Strategic Opportunities

Despite these risks, strategic investment can yield significant returns:

- Focus on Infrastructure: Areas near new or upgraded infrastructure projects typically see an increase in property values. Investing in such areas can offer higher returns as the projects come to fruition. For example, properties near the Cross River Rail and Brisbane Metro are likely to benefit significantly.

- Rental Market Strength: With Brisbane's low vacancy rates and the projected increase in rents, investing in properties with high rental yield potential could be particularly profitable. According to SQM Research, the rental market's strength makes it an attractive option for investors looking for steady income.

What are the current property market trends in Brisbane?

The Brisbane property market is experiencing steady growth, driven by economic stability, infrastructure development, and population increase. Residential and commercial properties are in high demand, with key suburbs showing strong capital growth.

Is Brisbane a good place to invest in property?

Yes, Brisbane is considered a favourable location for property investment due to its growing economy, infrastructure projects, and high quality of life. Investors can expect good returns, particularly in well-located suburbs.

Which suburbs in Brisbane are best for property investment?

Suburbs like New Farm, Paddington, and West End are consistently considered among the best for property investment due to their amenities, proximity to the CBD, and strong market demand.

How does infrastructure development impact property values in Brisbane?

Infrastructure projects such as the Brisbane Metro and Cross River Rail improve connectivity and accessibility, which in turn boosts property values in surrounding areas. These projects enhance the overall attractiveness of the city, making it a more desirable place to live and invest.

What is the expected population growth in Brisbane?

Brisbane’s population is projected to grow by 1.9% annually, reaching over 2.5 million by 2025. This growth is driven by both interstate migration and international arrivals, increasing demand for housing.

How CAPEX Property Can Help

As we look towards 2025, Brisbane's property market presents numerous opportunities for informed investors. By focusing on strategic areas, aligning with expert property managers like CAPEX Property, and staying adaptable to market conditions, investors can not only anticipate but also capitalise on the potential growth in this vibrant city. Contact

CAPEX Property today to start maximizing your investment potential in Brisbane.

Share this with friends!

Latest Property Market Insights